LIT UPDATE & COMMENTARY

OCT 20, 2024

In the prior case, Mass was represented by the notorious lawyer Robert Clayton Vilt. In this current case, we’ve uncovered that after starting out pro se in Harris County District Court, Mass has retained fellow Bandit lawyer Erick Joseph Delarue. LIT suggests that Delarue has effectively “stepped into Vilt’s shoes” during Vilt’s emergency break from taking on more foreclosure defense cases—an absence that initially led to his resignation nearly a year ago, though that agreement was swiftly retracted.

There’s tremendous public scrutiny and media attention on our federal and state courts nationwide. Immunity has enabled civil disobedience and fraud by those in black robes—judges who are supposed to work for the people—allowing regular criminal activity to flourish.

LIT continues to shine a spotlight on the misconduct of federal judges and politically influenced state judges. As a result, we have become targets of retaliation from various government agencies. With that context, let’s return to the case at hand: Mass v. Wells Fargo Bank.

This case should have been a straightforward dismissal with prejudice, as it is the second case based on the same facts, and the homeowner lacks a valid reason to halt foreclosure. Mass received a substantial payment of $65,000 towards her original loan of $228,000. This situation is simply outrageous.

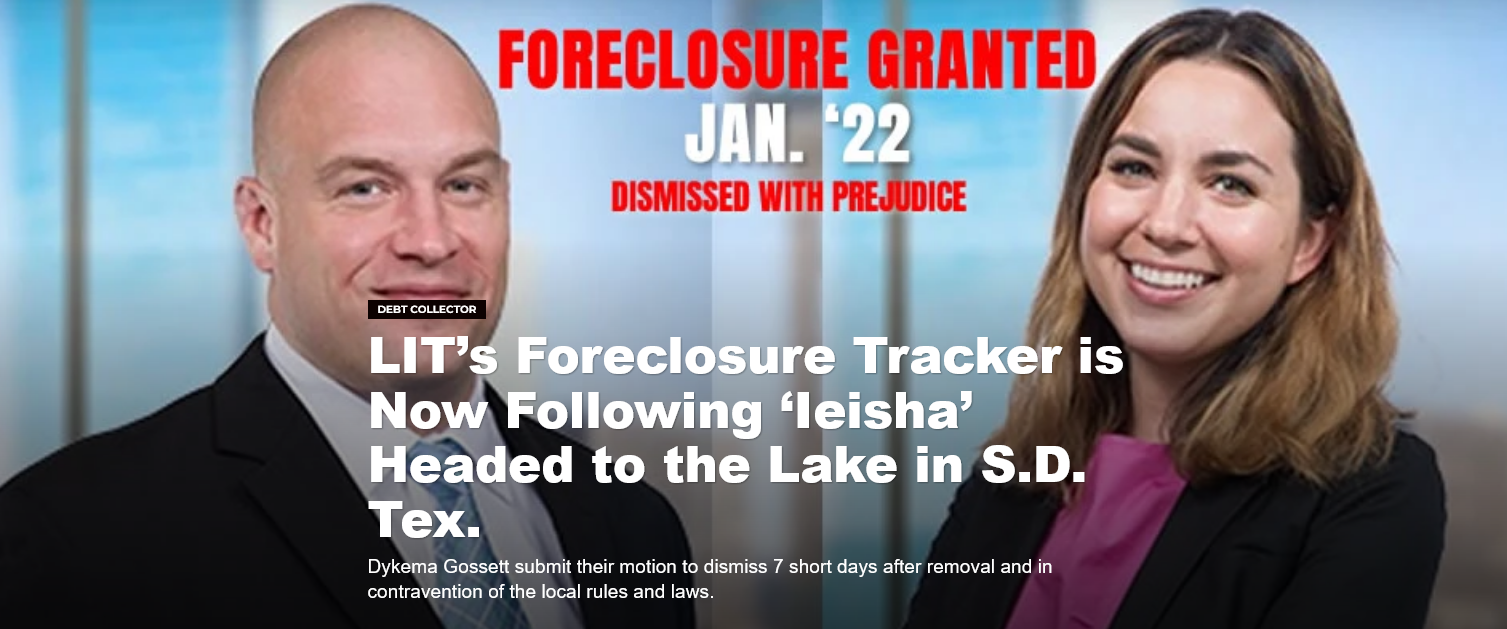

However, Judge Ewing Werlein’s acts defy his own federal laws. Due to recent events, we’ve returned to the Mass case to analyze the facts in further detail, and to do so we first recovered the operative motion to dismiss filed by Dykema. That motion agreed with LIT’s earlier suggestion that this case should be dismissed with prejudice on res judicata grounds.

Judge Werlein refused that argument and quickly dismissed the case for want of prosecution, without prejudice. So why did Senior Judge Ewing Werlein dismiss the case without prejudice despite there being a prior suit in this court dismissed with prejudice by Judge Sim Lake?

First, LIT noted that after striking Dykema’s first motion to dismiss claiming the pro se wasn’t notified properly, the second motion was submitted with notice going not only to Mass, but to Bandit foreclosure defense lawyer Erick “Delarogue” Delarue.

This raises alarm bells. Why was Delarogue hidden from the docket? When did he officially appear? Why was there no notice of appearance?

Second, Judge Werlein had acted maliciously in Joanna Burke’s case around the same time. There, he invited motions for summary judgment and a pre-filing injunction after inventing jurisdiction to purportedly rule on the proceedings.

The evidence of judicial bias is clear and obvious. When blackletter rules and laws are being ignored to issue manufactured opinions and glossed orders, and you are willfully and maliciously trampling on Constitutional due process and civil rights, that is unquestionably “judicial activism”.

DEFENDANT’S MOTION TO DISMISS PLAINTIFF’S ORIGINAL PETITION PURSUANT TO FED. R. CIV. P. 12(b)(6)

OCT 20, 2024

Defendant, Wells Fargo Bank, N.A., as Trustee for Option One Mortgage Loan Trust 2005- 4 Asset-Backed Certificates, Series 2005-4, (“Wells Fargo”), pursuant to Rule 12(b)(6) of the Federal Rules of Civil Procedure, respectfully moves this Honorable Court for dismissal of this action and Plaintiff’s attempted claims, if any, asserted against Wells Fargo in her Original Petition (the “Petition”)1 on the basis that the claims are barred by res judicata and collateral estoppel and the petition fails to allege facts, allegations, legal theories or causes of action sufficient to state a claim upon which relief can be granted under FED. R. CIV. P. 12(b)(6).

I. Nature and Stage of the Proceedings

1. Plaintiff filed this suit, ostensibly to delay a foreclosure sale, despite admitting that she had not maintained loan payments.2

On May 6, 2024, Plaintiff Ieisha Mass (“Plaintiff”) filed her

1 Plaintiffs’ Original Petition & Application for Injunctive Relief, Docket No. 1-3.

2 Id. at 3.

Original Petition, Petition for Declaratory Relief, and Application for Injunctive Relief Application in Cause No. 2024-28811, in the 11th District Court of Harris County, Texas (the “Action”). 3

2. On May 13, 2024, Defendant Wells Fargo timely removed the Action to this Court.4

Wells Fargo now moves to dismiss Plaintiff’s claims as reflected in her Original Petition on the basis that Plaintiff’s claims are barred by res judicata and collateral estoppel and Plaintiff fails to state a claim upon which relief can be granted pursuant to FED. R. CIV. P. 12 (b)(6).

II. Factual Background

3. According to Plaintiff’s Petition, on or about August 1, 2005, Plaintiff executed a Deed of Trust in favor of Option One Mortgage Corporation of a $228,000.00 promissory note against the real property located 9514 Woodcliff Lake Drive, Spring, Texas 77379 (“Property”).5

The Deed of Trust is assigned of record to Wells Fargo Bank.6 Plaintiff admits that she defaulted on the terms of the note and Deed of Trust.7

4. According to Plaintiff’s Petition, she began to experience financial difficulties during the COVID-19 pandemic.8

5. Prior to the instant lawsuit, on September 2, 20219, Plaintiff brought a lawsuit against Defendant in Harris County District Court, alleging causes of action for declaratory judgment, breach of contract, violation of the Real Estate Settlement Procedures Act (“RESPA”), and seeking

3 Id., Docket No. 1-3.

4 Defendant’s Notice of Removal, Docket 1-1.

5 Plaintiffs’ Original Petition & Application for Injunctive Relief, Docket No. 1-3 at 3.

6 Plaintiffs’ Original Petition & Application for Injunctive Relief, Docket No. 1-3 at 4.

7 Id.

8 Id.

9 Defendant respectfully asks the Court to take judicial notice of the previous lawsuit filed by Plaintiff, Ieisha Mass v. Wells Fargo Bank, NA, Cause No. 2021-56535, filed in the District Court of Harris County, Texas.

a temporary restraining order.10

In that suit, Plaintiff alleged that she submitted a loan modification request in March 2022 to PHH Mortgage Corporation (“PHH”)—Wells Fargo’s mortgage servicer—but the application was not approved or denied prior to Wells Fargo setting the Property for foreclosure sale on September 7, 2021.11

Wells Fargo timely removed the litigation to this Court.

Thereafter, Wells Fargo filed a motion to dismiss for failure to state a claim.1

On January 6, 2022, the Court granted Wells Fargo’s Motion to Dismiss.13

6. In the instant suit, Plaintiff now alleges that, in October 2023, PHH provided her with a verbal reinstatement quote of $110,000, which was to paid by November 25, 2023.14

Plaintiff further alleges that, on November 25, 2023, she submitted complete payment.15

Plaintiff alleges that the payment was rejected.16

According to Plaintiff, PHH then issued a new reinstatement quote of $123,949.46, for which payment was due on January 7, 2024. 17

Plaintiff did not accept the new reinstatement quote, and the Property was set for a May 7, 2024 foreclosure sale.18

7. Based upon these allegations, Plaintiffs filed suit against Wells Fargo on May 6, 2024 in Harris County District Court alleging causes of action for breach of contract, negligence, wrongful

10 Id.

11 Id. Plaintiff pled claims of breach of contract, violations of the Real Estate Settlement Procedures Act, breach of good faith and fair dealing, breach of duty of cooperation breach of common law tort of unreasonable collection efforts, negligent misrepresentation, common law fraud and sought declaratory relief.

12 Ieisha Mass v. Wells Fargo Bank, NA, Case No. 4:21-cv-2962; filed in the United States District for the Southern District of Texas Houston, Division.

13 Id., Docket 18.

14 Plaintiffs’ Original Petition & Application for Injunctive Relief, Docket No. 1-3 at 3.

15 Id.

16 Id.

17 Id.

18 Id. at 4.

foreclosure, slander of title, and seeking a declaratory action and temporary restraining order.19 Wells Fargo timely removed the litigation to this Court on May 13, 2024.20

III. Applicable Legal Standard

8. “In deciding a Rule 12(b)(6) motion to dismiss, the court evaluates the sufficiency of [plaintiff’s] complaint by ‘accepting well-pleaded facts as true, viewing them in the light most favorable to plaintiff.”

Bramlett v. Med. Protective Co. of Fort Wayne, Inc., 855 F.Supp.2d 615, 618 (N.D. Tex. 2012) (quoting In re Katrina Canal Breaches Litig., 495 F.3d 191, 205 (5th Cir. 2007) (internal quotation marks and alteration omitted)).

Under Rule 12(b)(6), the plaintiff must plead “enough facts to state a claim to relief that is plausible on its face.” Bell Atl. Corp. v. Twombly, 550 U.S. 544, 570, 127 S. Ct. 1955, 167 L. Ed. 2d 929 (2007).

“A claim has facial plausibility when the plaintiff pleads factual content that allows the court to draw the reasonable inference that the defendant is liable for the misconduct alleged.”

Ashcroft v. Iqbal, 556 U.S. 662, 678, 129 S. Ct. 1937, 173 L. Ed. 2d 868 (2009).

IV. Arguments and Authorities

A. Plaintiff’s claims are barred by res judicata.

9. Plaintiff’s Petition is fundamentally premised on the same claims, factual allegations, and legal conclusions that were fully and finally adjudicated in by this Court. 21

Consequently, this Court should dismiss the Petition as barred by res judicata.

10. Res judicata, or claim preclusion, “bars litigation of claims that either have been litigated or could have been raised in an earlier suit.”

Test Masters Educational Servs., Inc. v. Singh, 428 F.3d 559, 571 (5th Cir. 2005) (emphasis added).

19 Plaintiffs’ Original Petition & Application for Injunctive Relief, Docket No. 1-3.

20 Defendant’s Notice of Removal, Docket 1-1.

21 Ieisha Mass v. Wells Fargo Bank, NA, Case No. 4:21-cv-2962; filed in the United States District for the Southern District of Texas Houston, Division, Docket 18.

“The test for res judicata has four elements:

(1) the parties are identical or in privity;

(2) the judgment in the prior action was rendered by a court of competent jurisdiction;

(3) the prior action was concluded by a final judgment on the merits;

and

(4) the same claim or cause of action was involved in both actions.” Id.

To determine whether both suits involve the same cause of action, the Court of Appeals for the Fifth Circuit employs a transactional test—a prior judgment’s preclusive effect extends to all rights of the plaintiff with respect to all or any part of the transaction out of which the original action arose.

Petro-Hunt, L.L.C. v. United States, 365 F.3d 385, 395-96 (5th Cir. 2004).

Thus, res judicata precludes “litigation of all grounds for, or defenses to, recovery that were previously available to the parties, regardless of whether they were asserted or determined in the prior proceeding.”

Southmark Props. v. Charles House Corp., 742 F.2d 862, 872 (5th Cir. 1984).

11. All of the elements are met here.

i. The parties are identical in privity to those in the prior lawsuit.

12. First, in order for res judicata to apply, the parties in both actions must be identical or in privity.

See Test Masters Educ. Serv., 428 F.3d at 571.

When a non-party to the prior action is a successor in interest in property, that is sufficient to establish privity in the current action.

See Southwest Airlines Co. v. Texas Int’l Airlines, Inc., 546 F.2d 84, 95 (5th Cir. 1977).

There is no dispute that both Plaintiff and Wells Fargo, itself or in its capacity as successor trustee, were parties to the 2021 action, which culminated in this Court granting Wells Fargo’s motion to dismiss in January 2022.22

Accordingly, the first element of res judicata is satisfied.

ii. Prior judgment rendered by a court of competent jurisdiction.

13. Second, in order for res judicata to apply, the judgment in the prior action must be rendered by a court of competent jurisdiction.

See Test Masters Educ. Serv., 428 F.3d at 571.

A court is of competent jurisdiction if it has subject matter jurisdiction or is otherwise permitted to hear the claim.

See, e.g., Murchison Capital Partners, L.P. v. Nuance Communs., Inc., 625 Fed. App’x 617, 624 (5th Cir. 2015) (citing Browning v. Navarro, 887 F.2d 553, 558-59 (5th Cir. 1989)).

The court in the previous action, the United State District Court for the Southern District of Texas, Houston Division, is a court of competent jurisdiction because it had subject matter jurisdiction and was otherwise permitted to hear the claims brought.23

Therefore, the judgment in the prior action was rendered by a court of competent jurisdiction for res judicata purposes.

iii. The prior action was concluded by a final judgment on the merits.

14. Third, for res judicata to apply, the prior action must have concluded with a final judgment on the merits of the case.

See Test Masters Educ. Serv., 428 F.3d at 571. “A court’s decision to grant a motion to dismiss qualifies as actual litigation because dismissal with prejudice is ‘a final judgment on the merits.’” United States ex rel. Gage v. Rolls-Royce N. Am., Inc., 760 Fed. Appx. 314, 317 .

15. The January 2022 grant of Wells Fargo’s motion to dismiss Plaintiff’s claim is a final judgment for these purposes and satisfies this element of res judicata.

iv. The same claim or cause of action was involved in both actions.

16. Fourth, res judicata applies when the same claim or cause of action was raised or could have been raised in the prior action.

See Test Masters Educ. Serv., 428 F.3d at 571.

As stated previously, res judicata does not actually require the exact same causes of action to be raised in both actions, but rather concerns two identical actions “based on the same nucleus of operative facts.”

Id. (emphasis added).

In other words, when both actions arise out of a materially similar factual scenario, new or similar causes of actions cannot be raised later when a party had the opportunity to raise them previously.

17. The Fifth Circuit utilizes the “transactional test” to determine whether the same claim or cause of action exists.

See Test Masters Educ. Serv., 428 F.3d at 571.

The transactional test essentially defines the transaction or transactions connected to the original action and purportedly connected by the current action, by considering “whether the facts are related in time, space, origin or motivation, whether they form a convenient trial unit, and whether their treatment as a unit conforms to the parties’ expectations or business understanding or usage.”

Id.

18. For example, in Warren v. Mortgage Electronic Registration Systems, where a borrower attempted a third suit against a servicer on his loan, the Fifth Circuit held that because “[e]ach of the suits is based on the same loan that [the plaintiff] obtained in 2006,” simply “raising new claims. . . does not allow [him] to avoid the preclusive effects of the prior judgments.” 616 Fed. App’x 735, 737 (5th Cir. 2015).

In other words, since the current litigation involved the same essential facts, namely the borrower’s loan, it arose “from the same nucleus of operative facts.”

Id.

19. Similarly, here all of Plaintiff’s causes of action concern the note, Deed of Trust, and Wells Fargo’s right to foreclose. In the 2021 Action, all of Plaintiff’s claims stemmed from the 2005 Deed of Trust and Loan on the Property and Wells Fargo’s right to foreclose.24

The district court rejected all of Plaintiff’s claims and granted Wells Fargo’s motion to dismiss.

20. Plaintiff’s claims in this action not only reference the same Loan and challenge Wells Fargo’s right to foreclose, they raise many of the same legal arguments aimed at stoppingforeclosure that were considered and rejected by this Court previously.

Plaintiff’s claims here fall into one of two camps:

i) claims identical to both suits (breach of contract and declaratory judgment for wrongful foreclosure),

and

ii) red herring claims which are end run attacks on Wells Fargo’s ability to foreclosure (a claim for injunctive relief, negligence, and slander of title).

Plaintiff’s additional causes of action here will not preclude this action from dismissal based on res judicata because all of her claims are simply attacks on the validity of foreclosure and could have been litigated in the 2021 suit.

Ries v. Paige (In re Paige), 610 F.3d 865, 873 (5th Cir. 2010)

(“Essential to the application of the doctrine of res judicata is the principle that the previously unlitigated claim could or should have been brought in the earlier litigation.”).

21. In sum, this is a textbook example of causes of action that should have been brought in the previous action and arise out the same nucleus of operative facts because the factual scenario has not materially changed.

The Plaintiff is still asserting claims regarding the Property, regarding the same Loan litigated about in the previous action, and is still trying to thwart foreclosure on the statute of limitations.

Because these claims have, or could have been, litigated in the 2021 lawsuit, Plaintiff’s claims in this action are entirely barred by res judicata.

B. Plaintiff’s claims are barred by collateral estoppel.

22. In addition to res judicata, the collateral estoppel doctrine bars Plaintiff’s claims. Whereas res judicata precludes relitigation of previously adjudicated claims, collateral estoppel precludes relitigation of issues or facts that have already been decided in a prior litigation.

Hammervold v. Blank, 3 F.4th 803, 811 (5th Cir. 2021).

The requirements for collateral estoppel include:

“ (1) the issue of fact or law sought to be litigated in the second action was fully and fairly litigated in the first action;

(2) the facts were essential to the judgment in the first action;

and

(3) the parties were cast as adversaries in the first action.” Id.

23. For the reasons discussed above in support of res judicata, each of the elements for collateral estoppel are satisfied in this action.

Accordingly, the Petition should be dismissed on collateral estoppel grounds as well.

C. Plaintiff fails to state a claim for breach of contract.

24. Plaintiff alleges Wells Fargo breached the Deed of Trust related to the alleged reinstatement quote.

First, Plaintiff cannot establish Well Fargo breached the Deed of Trust because she admits the loan is in default.25

Dobbins v. Redden, 785 S.W.2d 377, 378 (Tex. 1990) (internal quotation marks omitted)

(“It is a well-established rule that a party to a contract who is himself in default cannot maintain a suit for its breach.”).

Further, “a claim for breach of a note and deed of trust must identify the specific provision in the contract that was breached.”

Williams v. Wells Fargo, NA, 650 F. App’x 223, 238 (5th Cir.2014).

Here, Plaintiff fails to identify any specific provision in the deed of trust or any other contract that Wells Fargo breached.

25. Second, Plaintiff cannot establish breach of the alleged verbal reinstatement agreement,26 as the agreement must be in writing in order to be enforceable because the loan is subject to Section 26.02 of the Texas Business and Commerce Code.

See Gordon v. JPMorgan Chase Bank, NA, 505 F’ App’x 361, 364 (5th Cir. 2013)(citations omitted).

The $228,000 loan is subject to the statute of frauds.

See TEX. BUS. & COM. CODE § 26.02(a)(2) and (b)

(a loan agreement involving a loan exceeding $50,000 in value is subject to the statute of frauds);

Fed. Land Bank Ass’n of Tyler v. Sloane, 825 S.W.2d 439, 442 (Tex.1991)

(any contract subject to the statute of frauds and not in writing is unenforceable under Texas law).

The Deed of Trust permits foreclosure if there is a

25 Plaintiffs’ Original Petition & Application for Injunctive Relief, Docket No. 1-3.

26 Id.

default and, therefore, any deviation from that written agreement must be made in writing to comply with the statute of frauds.27

See Jackson v. Deutsche Bank Nat’l Trust Co., 2015 U.S. Dist. LEXIS 152339, at *17 (N.D. Tex. Oct. 14, 2015); see also Barcenas v. Federal Home Loan Mortgage Corp., 2013 U.S. Dist. LEXIS 9405, 2013 WL 286250 (S.D. Tex. Jan. 24, 2013).

Yet Plaintiff does not provide any proof that Wells Fargo made a promise in writing to grant a reinstatement.

26. Third, the breach of contract claim fails because Wells Fargo’s alleged breach of the Deed of Trust did not cause Plaintiff any damages.

There is no dispute that Plaintiff obtained a temporary restraining order preventing a foreclosure and she remains in possession of the Property.28

Moreover, Plaintiff does not have any damages for attorneys’ fees, given that she is a pro se litigant.

Richardson v. Wells Fargo Bank, N.A., 740 F.3d 1035, 1038 (5th Cir. 2014).

D. Plaintiff’s claim for negligence must be dismissed, because there is no legal duty between Plaintiff and Defendant, and it is barred by the economic loss doctrine.

27. Texas does not impose a legal duty on a mortgagee or mortgage servicer that would give rise to a negligence or negligent misrepresentation claim.

Scott v. Bank of Am., N.A., 597 F. App’x 223, 225 (5th Cir. 2014)

(noting that there is no legal duty between parties to a contract absent some special relationship between them and holding that no such special relationship exists between mortgagor and mortgagee).

Because no legal duty exists, Plaintiff’s negligence claim fails as a matter of law and should be dismissed with prejudice.

28. Further, any claim sounding in negligence is barred by the economic loss doctrine, which “generally precludes recovery in tort for economic losses resulting from the failure of a party to

27 Exhibit A, Deed of Trust ¶ 11 (non-waiver provision), ¶ 21 (following acceleration lender may foreclose if borrower does not cure their default or payoff the total debt—Plaintiff alleges she did neither”).

28 Signed Order Granting Temporary Restraining Order, Docket No. 1-5.

perform under a contract.”

Lamar Homes, Inc. v. Mid-Continent Cas. Co., 242 S.W.3d 1, 12 (Tex. 2007).

Tort claims are generally not viable if the defendant’s conduct “would give rise to liability only because it breaches the parties’ agreement.”

Sw. Bell Tel. Co. v. DeLanney, 809 S.W.2d 493, 494 (Tex. 1991).

To determine whether a tort claim is “merely a repackaged breach of contract claim,” a court considers whether the claim alleges a breach of duty created by contract rather than one imposed by law and whether the injury is only the economic loss to the subject of the contract itself.

Johnson v. Wells Fargo Bank, NA, 999 F. Supp. 2d 919, 930-31 (N.D. Tex. 2014).

In this case, Plaintiff fails to allege an existing duty arising separate and apart from the loan documents.

See id. at 930

(holding that plaintiff’s claims that defendants negligently made false statements regarding loan modification were barred by the economic loss doctrine because the plaintiff failed to allege a duty or an injury independent from the subject matter of the contract).

Thus, Plaintiff’s negligence claim as pled is barred by the economic loss doctrine.

E. Plaintiff’s claim for wrongful foreclosure is not ripe for adjudication.

29. Plaintiff’s property has not yet been sold at foreclosure. Plaintiff’s allegations regarding wrongful foreclosure are, therefore, not yet ripe.

Likewise, to the extent her other claims are based on an alleged wrongful foreclosure, it is also premature.

One of the elements of wrongful foreclosure is an irregularity in the sale, and where no sale has yet occurred, courts have concluded that a claim for wrongful foreclosure cannot succeed.

See Allied Capital Corp v. Cravens, 67 S.W.3d 486, 492 (Tex. App.—Corpus Christi [13th Dist.] 2002, no pet.)

(holding that in a suit for wrongful foreclosure, a foreclosure sale must have occurred)

(citing Charter Nat’l Bank-Houston v. Stevens, 781 S.W.2d 368, 371 (Tex. App.—Houston [14th Dist.] 1989, writ denied).

PHH has not sold the Property at foreclosure sale, Plaintiff has not suffered any harm, and the claims are premature.29

The claim must be dismissed.

F. Slander of title should be dismissed, because Plaintiff fails to assert any factual allegations in support of her claim.

30. To succeed in an action for slander of title, a party must allege and prove that the defendant,

(1) with legal malice,

(2) uttered and published disparaging words about plaintiff’s title to property that were false

and

(3) resulted in the loss of a specific sale.

Cantu v. Fed. Home Loan Mortg. Corp., No. M-12-103, 2012 U.S. Dist. LEXIS 204642 (S.D. Tex. 2012).

31. In Plaintiff’s Original Petition, Plaintiff states:

“Mass possessed an estate or interest in the Property; Wells Fargo uttered and published a disparaging statement about the title of the Property; the statement was false; the statement was published with legal malice; and the publication caused special damages.”30

32. Plaintiff simply recites the elements of a slander of title claim without any factual allegations to support the claim.

Plaintiff fails to provide any specific instances in which Wells Fargo made a statement about Plaintiff’s property, much less knew that the alleged statement was false or acted in reckless disregard of the truth or falsity.

Louis v. Blalock, 543 S.W.2d 715, 717 (Tex.Civ.App. Amarillo 1976, writ ref’d n.r.e.).

Furthermore, Plaintiff fails to allege any loss of a specific sale.

In Texas, special damages in a slander of title are typically proven by showing that plaintiff lost a specific sale or other transaction as a result of the disparaging statement.

See Cantu, 2012 U.S. Dist. LEXIS 204642.

Plaintiff does not allege any specific lost sale.

Therefore, Plaintiff has failed to state a claim for slander of title, and it should be dismissed.

29 Plaintiffs’ Original Petition & Application for Injunctive Relief, Docket No. 1-3.

30 Id. at 6.

G. Injunctive relief should be denied.

33. The request for injunctive relief is improper because the underlying claims fail as a matter of law and fact.

See Smith v. Wells Fargo Bank, N.A., Civ. Action No. H-14-283, 2014 U.S. Dist. LEXIS 104443, at *6 (S.D. Tex. July 31, 2014)

(“Because all of plaintiff’s underlying claims fail as a matter of law, her requests for injunctive relief and attorneys’ fees likewise must be denied.”) (citations omitted).

As such, the request should be dismissed.

H. Request for declaratory judgment must be dismissed.

34. The request for declaratory judgment should be dismissed because the grounds supporting the request fail as a matter of law and fact.

See Conrad v. SIB Mortgage Corp., No. 4:14-CV-915- A, 2015 U.S. Dist. LEXIS 28349, at *7 (N.D. Tex. Mar. 6, 2015)

(“A declaratory judgment action requires the parties to litigate some underlying claim or cause of action.”).

To the extent the request for declaratory relief is an independent cause of action it should be dismissed with prejudice.

35. The Court should also dismiss the declaratory judgment claim because it is duplicative of the breach of contract claims.

See Ventura v. Wells Fargo Bank, N.A., 2017 U.S. Dist. LEXIS 47517 (N.D. Tex. Mar. 30, 2017)

(Dismissing declaratory judgment action because “a declaration that ‘(a) [] Defendant has failed to cure Constitutional defects in the loan documents, (b) . . . the mortgage lien is noncompliant with the Texas Constitution and thereby VOID, and (c) . . . title be quieted in Plaintiffs’ name[ ]’” . . . “simply mirror their claims for breach of contract and quiet title; adjudication of those claims will resolve all of the issues present in this action.”);

Cypress/Spanish Ft. I, L.P. v. Prof’l Serv. Indus., Inc., 814 F. Supp. 2d 698, 710 (N.D. Tex. 2011)

(stating that if a request for declaratory judgment adds nothing to an existing lawsuit, it need not be permitted

(citing Madry v. Fina Oil & Chem. Co., 44 F.3d 1004 (5th Cir. 1994)).

The request should therefore be dismissed.

V. Conclusion and Prayer

For each of the foregoing reasons, Defendant prays the court grant this motion and dismiss the claims asserted by Plaintiff with prejudice. Defendant further requests the court award such other relief, in law or in equity, to which Defendant may be justly entitled.

Dated: August 14, 2024 Respectfully Submitted,

/s/ José M. (“Joe”) Rubio III

JOSÉ M. (“JOE”) RUBIO III

State Bar No. 24084576

Southern District No. 2952046

E-Mail: jrubio@dykema.com

DYKEMA GOSSETT, PLLC

1717 Main Street, Suite 4200

Dallas, Texas 75201

(214) 462-6400

(214) 462-6401 (fax)

-and-

Stephanie Sepulveda

State Bar No. 24106418

Southern District No. 3630278

Email: ssepulveda@dykema.com

DYKEMA GOSSETT, PLLC

1401 McKinney St., Suite 1625

Houston, Texas 77004

(713) 904-6892

ATTORNEYS FOR DEFENDANT

CERTIFICATE OF SERVICE

I certify that a true and correct copy of the foregoing document was served upon Plaintiff and Plaintiff’s counsel on August 14, 2024 via electronic mail, first class mail and CMRR in compliance with the Federal Rules of Civil Procedure.

Ieisha Mass

9514 Woodcliff Lake Dr.

Spring, Texas 77379

ieishamass@yahoo.com

Erick DeLaRue

The Law Office of Erick DeLaRue, PLLC

2800 Houston, Texas 77056

erick.delarue@delaruelaw.comCounsel for Plaintiff

//s/ José M. (“Joe”) Rubio III

JOSÉ M. (“JOE”) RUBIO III

LIT UPDATE & COMMENTARY

MAY 19, AUG 14, 19 2024

Judge Werlein is issuin’ orders after self-recusing from Joanna Burke’s lawsuit without comment. Clearly, it wasn’t a personal illness or similar that prevented him from remainin’ on the case.

The most recent case involving Wells Fargo and Judge Kenneth Hoyt we could locate is:

Hedner v. Wells Fargo Bank, N.A. (4:23-cv-00964) District Court, S.D. Texas which was removed from state court #334. This involved The Lane Law Firm as defense counsel for David and Susan Hedner, and Locke Lord representing Wells Fargo.

Judge Hoyt also recused on the case (see docket in next tab below) and would be replaced by Judge Hittner. So unlike Fifth Circuit Judge Don Willett, who won’t recuse for financial interests in banking institutions, Judge Hoyt is self recusing.

U.S. District Court

SOUTHERN DISTRICT OF TEXAS (Houston)

CIVIL DOCKET FOR CASE #: 4:23-cv-00964

| Hedner et al v. Wells Fargo Bank, N.A. Assigned to: Judge David Hittner

Cause: 28:1444 Petition for Removal- Foreclosure |

Date Filed: 03/16/2023 Date Terminated: 10/12/2023 Jury Demand: Plaintiff Nature of Suit: 220 Real Property: Foreclosure Jurisdiction: Diversity |

| Plaintiff | ||

| David W. Hedner | represented by | David W. Hedner 16003 Pebble Creek Trail Cypress, TX 77433 281-961-6788 PRO SEJoshua David Gordon The Lane Law Firm, PLLC 6200 Savoy Dr Ste 1150 Houston, TX 77036 713-595-8224 Email: joshua.gordon@lanelaw.com TERMINATED: 05/25/2023 LEAD ATTORNEY ATTORNEY TO BE NOTICEDRobert Chamless Lane The Lane Law Firm 6200 Savoy Drive Ste 1150 Houston, TX 77036-3300 713-595-8200 Email: notifications@lanelaw.com TERMINATED: 05/25/2023 LEAD ATTORNEY ATTORNEY TO BE NOTICED |

| Plaintiff | ||

| Susan M. Hedner | represented by | Susan M. Hedner 16003 Pebble Creek Trail Cypress, TX 77433 281-961-6788 PRO SEJoshua David Gordon (See above for address) TERMINATED: 05/25/2023 LEAD ATTORNEY ATTORNEY TO BE NOTICEDRobert Chamless Lane (See above for address) TERMINATED: 05/25/2023 LEAD ATTORNEY ATTORNEY TO BE NOTICED |

| V. | ||

| Defendant | ||

| Wells Fargo Bank, N.A. | represented by | Benjamin David Lee Foster Locke Lord LLP 300 Colorado Street Ste 2100 Austin, TX 78701 512-305-4751 Email: dfoster@lockelord.com LEAD ATTORNEY ATTORNEY TO BE NOTICEDRobert T Mowrey Locke Lord LLP 2200 Ross Ave Ste 2800 Dallas, TX 75201-6776 214-740-8000 Fax: 214-740-8800 Email: rmowrey@lockelord.com LEAD ATTORNEY ATTORNEY TO BE NOTICEDElizabeth Kristin Duffy Locke Lord LLP 2200 Ross Ave Ste 2800 Dallas, TX 75201 214-740-8673 Email: eduffy@lockelord.com TERMINATED: 08/25/2023Helen Onome Turner Locke Lord LLP 600 Travis Street Ste 2800 Houston, TX 77002 713-226-1280 Fax: 713-229-2501 Email: helen.turner@lockelord.com ATTORNEY TO BE NOTICED |

| Date Filed | # | Docket Text |

|---|---|---|

| 03/16/2023 | 1 | NOTICE OF REMOVAL from 334th Judicial District Court, Harris County, Texas, case number 2023-14107 (Filing fee $ 402 receipt number ATXSDC-29608313) filed by Wells Fargo Bank, N.A.. (Attachments: # 1 Exhibit / Exhibits A – H)(Turner, Helen) (Entered: 03/16/2023) |

| 03/16/2023 | 2 | CERTIFICATE OF INTERESTED PARTIES by Wells Fargo Bank, N.A., filed.(Turner, Helen) (Entered: 03/16/2023) |

| 03/16/2023 | 3 | CORPORATE DISCLOSURE STATEMENT by Wells Fargo Bank, N.A. identifying Wells Fargo & Company as Corporate Parent, filed.(Turner, Helen) (Entered: 03/16/2023) |

| 03/22/2023 | 4 | ORDER OF RECUSAL. Judge Kenneth M Hoyt recused. Case reassigned to Judge David Hittner for all further proceedings.(Signed by Judge Kenneth M Hoyt) Parties notified.(KimberlyPicota, 4) (Entered: 03/22/2023) |

| 03/23/2023 | 5 | ORDER for Initial Pretrial and Scheduling Conference and Order to Disclose Interested Persons. Initial Conference set for 5/18/2023 at 10:45 PM in video before Magistrate Judge Peter Bray(Signed by Judge David Hittner) Parties notified.(JosephWells, 4) (Entered: 03/23/2023) |

| 05/02/2023 | 6 | CERTIFICATE OF INTERESTED PARTIES by David W. Hedner, Susan M. Hedner, filed.(Lane, Robert) (Entered: 05/02/2023) |

| 05/08/2023 | 7 | NOTICE of Resetting. Parties notified. Initial Conference set for 5/18/2023 at 10:45 AM in by video before Magistrate Judge Peter Bray, filed. (JasonMarchand, 4) (Entered: 05/08/2023) |

| 05/15/2023 | 8 | NOTICE of Appearance by Elizabeth K. Duffy on behalf of Wells Fargo Bank, N.A., filed. (Duffy, Elizabeth) (Entered: 05/15/2023) |

| 05/17/2023 | 9 | JOINT DISCOVERY/CASE MANAGEMENT PLAN by David W. Hedner, Susan M. Hedner, filed.(Lane, Robert) (Entered: 05/17/2023) |

| 05/17/2023 | 10 | PROPOSED ORDER – Scheduling Order, filed.(Lane, Robert) (Entered: 05/17/2023) |

| 05/18/2023 | 11 | SCHEDULING ORDER. Trial Term: May/June 2024. ETT: 2 days. Jury trial. Amended Pleadings due by 5/31/2023. Joinder of Parties due by 5/31/2023 Pltf Expert Witness List due by 7/31/2023. Deft Expert Witness List due by 8/31/2023. Discovery due by 11/30/2023. Dispositive Motion Filing due by 12/29/2023. Non-Dispositive Motion Filing due by 12/29/2023. Joint Pretrial Order due by 4/30/2024.(Signed by Magistrate Judge Peter Bray) Parties notified.(JasonMarchand, 4) (Entered: 05/19/2023) |

| 05/24/2023 | 12 | Unopposed MOTION for Robert C. Lane, Joshua D. Gordon, and The Lane Law Firm, P.L.L.C. to Withdraw as Attorney by David W. Hedner, Susan M. Hedner, filed. Motion Docket Date 6/14/2023. (Attachments: # 1 Proposed Order)(Lane, Robert) (Entered: 05/24/2023) |

| 05/25/2023 | 13 | ORDER granting 12 Motion to Withdraw as Attorney. Attorney Joshua David Gordon and Robert Chamless Lane terminated. (Signed by Judge David Hittner) Parties notified.(JosephWells, 4) (Entered: 05/26/2023) |

| 08/01/2023 | 14 | Opposed MOTION for Elizabeth K. Duffy to Withdraw as Attorney by Wells Fargo Bank, N.A., filed. Motion Docket Date 8/22/2023. (Attachments: # 1 Proposed Order)(Duffy, Elizabeth) (Entered: 08/01/2023) |

| 08/25/2023 | 15 | ORDER granting 14 Motion to Withdraw Elizabeth K. Duffy as Counsel. Ms. Duffy is hereby withdrawn as counsel of record for Wells Fargo Bank, N.A. The docket will be amended to reflect Ms. Duffy has withdrawn as counsel for Defendant and no longer needs to be noticed of any pleadings, motions, or other documents filed or served in this case. (Signed by Judge David Hittner) Parties notified.(JosephWells, 4) (Entered: 08/25/2023) |

| 09/18/2023 | 16 | MOTION for Summary Judgment by Wells Fargo Bank, N.A., filed. Motion Docket Date 10/10/2023. (Attachments: # 1 Exhibit A, # 2 Exhibit A-1, # 3 Exhibit A-2, # 4 Exhibit A-3, # 5 Exhibit A-4, # 6 Exhibit A-5, # 7 Exhibit A-6, # 8 Exhibit A-7, # 9 Exhibit A-8, # 10 Exhibit A-9, # 11 Exhibit B, # 12 Exhibit B-1, # 13 Exhibit B-2, # 14 Exhibit C, # 15 Exhibit C-1, # 16 Exhibit D, # 17 Exhibit D-1, # 18 Proposed Order)(Turner, Helen) (Entered: 09/18/2023) |

| 10/12/2023 | 17 | ORDER granting 16 Motion for Summary Judgment. THIS IS A FINAL JUDGMENT. (Signed by Judge David Hittner) Parties notified.(JosephWells, 4) (Entered: 10/12/2023) |

| PACER Service Center | |||

|---|---|---|---|

| Transaction Receipt | |||

| 05/19/2024 13:09:19 |

Mass v. Wells Fargo Bank, National Association

as Trustee for Option One Mortgage Loan Trust 2005-4, Asset-Backed Certificates, Series 2005-4

(4:24-cv-01785)

District Court, S.D. Texas, Judge Hoyt Judge Werlein, Jr.

MAY 13, 2024

LIT: Why not with prejudice on res judicata grounds?

Tyler v. PHH Mortg. Servs., 3:24-cv-1597-K-BN, at *6 (N.D. Tex. July 3, 2024)

(“The Court should sua sponte dismiss this lawsuit with prejudice as barred by res judicata.”)

Tyler v. PHH Mortg. Servs., 3:24-cv-1597-K-BN, at *4 (N.D. Tex. July 3, 2024)

(“Here, the defendants have pleaded res judicata in their answer filed in state court. See Dkt. No. 1-9. But, although the defendants have not moved to dismiss, governing law “permits ‘[d]ismissal by the court sua sponte on res judicata grounds … in the interest of judicial economy where both actions were brought before the same court.’”

McIntyre v. Ben E. Keith Co., 754 Fed.Appx. 262, 264-65 (5th Cir. 2018) (per curiam) (quoting Mowbray v. Cameron Cnty., 274 F.3d 269, 281 (5th Cir. 2001)).

“The preclusive effect of a prior federal court judgment is controlled by federal res judicata rules.”

Ellis v. Amex Life Ins. Co., 211 F.3d 935, 937 (5th Cir. 2000) (citations omitted); accord Meza v. Gen. Battery Corp., 908 F.2d 1262, 1265 (5th Cir. 1990).”)

+++

ORDER TO SHOW CAUSE. ORDERED that Plaintiff, within ten (10) days after the entry of this Order, shall file a response to show cause, if any exists, why this case should not be dismissed without prejudice for want of prosecution.

If Plaintiff chooses not to respond, the Court will dismiss this case without prejudice.

Show Cause Response due by 8/26/2024.

(Signed by Judge Ewing Werlein, Jr) Parties notified. (mf4) (Entered: 08/16/2024)

Based on non-appearance at Initial Conf.

Minute Entry for proceedings held before Judge Ewing Werlein, Jr. RULE 16 SCHEDULING CONFERENCE held on 8/16/2024.

Pro Se Plaintiff Ieisha Mass although duly notified of the hearing failed to appear.

It is ORDERED that within ten (10) days after the entry of this Order, Plaintiff shall file a response to show cause, if any exists, why this cause of action should not be dismissed without prejudice for want of prosecution.

Appearances: Stephanie Sepulveda for Dft. Law Clerk: J. Summers (Court Reporter: Ed Reed), filed. (mf4) (Entered: 08/16/2024)

U.S. District Court

SOUTHERN DISTRICT OF TEXAS (Houston)

CIVIL DOCKET FOR CASE #: 4:24-cv-01785

| Mass v. Wells Fargo Bank, National Association as Trustee for Option One Mortgage Loan Trust 2005-4, Asset-Backed Certificates, Series 2005-4 Assigned to: Judge Ewing Werlein, Jr

Cause: 28:1446 Notice of Removal |

Date Filed: 05/13/2024 Jury Demand: None Nature of Suit: 190 Contract: Other Jurisdiction: Diversity |

| Date Filed | # | Docket Text |

|---|---|---|

| 08/14/2024 | 11 | MOTION to Dismiss Plaintiff’s Original Petition Pursuant to Fed. R. Civ. P. 12(b)(6) by Wells Fargo Bank, National Association as Trustee for Option One Mortgage Loan Trust 2005-4, Asset-Backed Certificates, Series 2005-4, filed. Motion Docket Date 9/4/2024. (Attachments: # 1 Proposed Order Granting Defendant’s Motion to Dismiss Plaintiff’s Original Petition Pursuant to Fed. R. Civ. P. 12(b)(6)) (Sepulveda, Stephanie) (Entered: 08/14/2024) |

| 08/16/2024 | 12 | Minute Entry for proceedings held before Judge Ewing Werlein, Jr. RULE 16 SCHEDULING CONFERENCE held on 8/16/2024. Pro Se Plaintiff Ieisha Mass although duly notified of the hearing failed to appear. It is ORDERED that within ten (10) days after the entry of this Order, Plaintiff shall file a response to show cause, if any exists, why this cause of action should not be dismissed without prejudice for want of prosecution. Appearances: Stephanie Sepulveda for Dft. Law Clerk: J. Summers (Court Reporter: Ed Reed), filed. (mf4) (Entered: 08/16/2024) |

| 08/16/2024 | 13 | ORDER TO SHOW CAUSE. ORDERED that Plaintiff, within ten (10) days after the entry of this Order, shall file a response to show cause, if any exists, why this case should not be dismissed without prejudice for want of prosecution. If Plaintiff chooses not to respond, the Court will dismiss this case without prejudice. Show Cause Response due by 8/26/2024. (Signed by Judge Ewing Werlein, Jr) Parties notified. (mf4) (Entered: 08/16/2024) |

| PACER Service Center | |||

|---|---|---|---|

| Transaction Receipt | |||

| 08/19/2024 15:10:57 |

ORDER Granting 7 Agreed MOTION for Continuance of

The June 14, 2024

Initial Pre-Trial and Scheduling Conference.

Initial Conference is RESET to

8/16/2024 at 03:30 PM

in Room 11521 before Judge Ewing Werlein, Jr.(Signed by Judge Ewing Werlein, Jr) Parties notified. (mf4) (Entered: 06/04/2024)

Motion to Dismiss

ORDER OF RECUSAL.

Judge Kenneth M Hoyt recused.

Case reassigned to Judge Ewing Werlein, Jr for all further proceedings.

(Signed by Judge Kenneth M Hoyt) Parties notified. (glc4) (Entered: 05/16/2024)

U.S. District Court

SOUTHERN DISTRICT OF TEXAS (Houston)

CIVIL DOCKET FOR CASE #: 4:24-cv-01785

| Mass v. Wells Fargo Bank, National Association as Trustee for Option One Mortgage Loan Trust 2005-4, Asset-Backed Certificates, Series 2005-4 Assigned to: Judge Ewing Werlein, Jr

Cause: 28:1446 Notice of Removal |

Date Filed: 05/13/2024 Jury Demand: None Nature of Suit: 190 Contract: Other Jurisdiction: Diversity |

| Plaintiff | ||

| Ieisha Mass | represented by | Ieisha Mass 9514 Woodcliff Lake Dr. Spring, TX 77379 2817363492 PRO SE |

| V. | ||

| Defendant | ||

| Wells Fargo Bank, National Association as Trustee for Option One Mortgage Loan Trust 2005-4, Asset-Backed Certificates, Series 2005-4 | represented by | Stephanie Sepulveda Dykema Gossett, PLLC 1401 McKinney St., Suie 1625 Houston, TX 77010 956-220-7129 Email: ssepulveda@dykema.com ATTORNEY TO BE NOTICED |

| Date Filed | # | Docket Text |

|---|---|---|

| 05/13/2024 | 1 | NOTICE OF REMOVAL from 11th Judicial District Court- Harris County, case number 202428811 (Filing fee $ 405 receipt number ATXSDC-31609338) filed by Wells Fargo Bank, National Association as Trustee for Option One Mortgage Loan Trust 2005-4, Asset-Backed Certificates, Series 2005-4. (Attachments: # 1 Appendix, # 2 Exhibit 1, # 3 Exhibit 2, # 4 Exhibit 3, # 5 Exhibit 4, # 6 Exhibit 5, # 7 Exhibit 6, # 8 Exhibit 7, # 9 Exhibit 8, # 10 Exhibit 9) (Sepulveda, Stephanie) (Entered: 05/13/2024) |

| 05/16/2024 | 2 | ORDER OF RECUSAL. Judge Kenneth M Hoyt recused. Case reassigned to Judge Ewing Werlein, Jr for all further proceedings. (Signed by Judge Kenneth M Hoyt) Parties notified. (glc4) (Entered: 05/16/2024) |

| 05/16/2024 | 3 | NOTICE of Reassignment. Parties notified, filed. (glc4) (Entered: 05/16/2024) |

| 05/16/2024 | 4 | ORDER for Initial Pretrial and Scheduling Conference and Order to Disclose Interested Persons. Initial Conference set for 6/14/2024 at 02:30 PM in Room 11521 before Judge Ewing Werlein, Jr. (Signed by Judge Ewing Werlein, Jr) Parties notified. (mf4) (Entered: 05/16/2024) |

| PACER Service Center | |||

|---|---|---|---|

| Transaction Receipt | |||

| 05/19/2024 12:25:36 |

Fmr U.S. bankruptcy Chief Judge David R. Jones is hoping to sink a subpoena from the U.S. Trustee’s Office for his banking records in connection with its inquiry into his concealed romantic relationship with a former Jackson Walker LLP partner Liz Freeman. pic.twitter.com/apVRJMbsEA

— lawsinusa (@lawsinusa) October 17, 2024

202428811 –

MASS, IEISHA vs. WELLS FARGO BANK NA

(AS TRUSTEE FOR OPTION ONE MORTGAGE

MAY 6, 2024

How did Mass obtain $65k from Texas Homeowners Assistance Fund during the 11 month Pandemic towards rent payments on a loan of $228k?

“Financial hardship means a material reduction in income or material increase in living expenses

associated with the coronavirus pandemic that has created or increased a risk of mortgage

delinquency, mortgage default, foreclosure, loss of utilities or home energy services, or

displacement for a homeowner.”

Mass v. Wells Fargo Bank, N.A.

(4:21-cv-02962)

District Court, S.D. Texas

SEP 10, 2021 | REPUBLISHED BY LIT: SEP 23, 2021

Don’t Mind Us, We’re Just Checkin’

Bandit: https://t.co/lcgqVdq7KR

Bandit: https://t.co/eJhEfnK82K

Perfect Scorecards, No Foul Play….

Bandit: https://t.co/Mp1pjksN5O

Fully Probated Suspension pic.twitter.com/Z6O1eRBn3k— lawsinusa (@lawsinusa) October 18, 2024

Vilt and Associates – Stop Foreclosure and Keep Your Home

This foreclosure defense law firm have a misleading advert which claims to have “saved” over 300 homes from foreclosure. We haven’t found a single home where these lawyers have won a case where the homeowner gets to “Keep Your Home” and this case is a prime example.

Indeed the homeowner submitted a comment on this page on January 4, 2022 asking that LIT take down this article as she most likely heard that her case was going to be dismissed after the cancelled conference which was to be heard on Jan. 7. On Jan 6, the order of foreclosure and dismissing her complaint was published on the docket.

The CFPB and the Texas Bar need to review and take the appropriate action against false and misleading advertising by professional lawyers who are preying on homeowners and their fear.

U.S. District Court

SOUTHERN DISTRICT OF TEXAS (Houston)

CIVIL DOCKET FOR CASE #: 4:21-cv-02962

| Mass v. Wells Fargo Bank, N.A. Assigned to: Judge Sim Lake

Cause: 28:1441 Notice of Removal |

Date Filed: 09/10/2021 Jury Demand: None Nature of Suit: 220 Real Property: Foreclosure Jurisdiction: Federal Question |

| Plaintiff | ||

| Ieisha Mass | represented by | Robert Clayton Vilt Vilt and Associates, P.C. 5177 Richmond Ave Ste 1142 Houston, TX 77056 713-840-7570 Fax: 713-877-1827 Email: clay@viltlaw.com LEAD ATTORNEY ATTORNEY TO BE NOTICED |

| V. | ||

| Defendant | ||

| Wells Fargo Bank, N.A. | represented by | Adam Ross Nunnallee Dykema Gossett PLLC 1717 Main St Ste 4200 Dallas, TX 75201 (214) 462-6400 Fax: (214) 462-6401 Email: ANunnallee@dykema.com LEAD ATTORNEY ATTORNEY TO BE NOTICEDMeredith Sohaila Tavallaee Dykema Gossett PLLC Comerica Bank Tower 1717 Main St. Ste. 4200 Dallas, TX 75201 214-698-7831 Email: mtavallaee@dykema.com ATTORNEY TO BE NOTICED |

| Date Filed | # | Docket Text |

|---|---|---|

| 09/10/2021 | 1 | NOTICE OF REMOVAL from 234th JDC Harris County, case number 2021-56535 (Filing fee $ 402 receipt number 0541-27028751) filed by Wells Fargo Bank, N.A., as Trustee. (Attachments: # 1 Exhibit)(Nunnallee, Adam) (Entered: 09/10/2021) |

| 09/16/2021 | 2 | ORDER for Initial Pretrial and Scheduling Conference and Order to Disclose Interested Persons. Initial Conference set for 1/7/2022 at 03:00 PM in Courtroom 9B before Judge Sim Lake. (Signed by Judge Sim Lake) Parties notified.(sanderson, 4) (Entered: 09/16/2021) |

| 09/16/2021 | 3 | CERTIFICATE OF INTERESTED PARTIES by Ieisha Mass, filed.(Vilt, Robert) (Entered: 09/16/2021) |

| 09/16/2021 | 4 | DESIGNATION OF EXPERT WITNESS LIST by Ieisha Mass, filed. (Attachments: # 1 Exhibit Resume of Robert Vilt)(Vilt, Robert) (Entered: 09/16/2021) |

| 09/16/2021 | 5 | INITIAL DISCLOSURES by Ieisha Mass, filed.(Vilt, Robert) (Entered: 09/16/2021) |

| 09/16/2021 | 6 | NOTICE of Appearance by Meredith Tavallaee on behalf of Wells Fargo Bank, N.A., filed. (Tavallaee, Meredith) (Entered: 09/16/2021) |

| 09/17/2021 | 7 | MOTION to Dismiss 1 Notice of Removal DEFENDANTS MOTION TO DISMISS ORIGINAL PETITION AND BRIEF IN SUPPORT by Wells Fargo Bank, N.A., filed. Motion Docket Date 10/8/2021. (Attachments: # 1 Exhibit)(Nunnallee, Adam) (Entered: 09/17/2021) |