“Screw Payin’, the Don Owes Us.”

That 7.2 Billion Dollar relief was to run until 2022 but Deutsche Bank CANCELLED the fine…yes, that’s right, former Attorney General Loretta Lynch said the Bank was to be held “accountable”for its abuse of homeowners and consumers and the fine represented that statement…hmmm, well, okay…that went well.

Deutsche Bank – Q2 Earnings: The Mountain Just Got Bigger

2Q earnings were greeted with another 5% share price fall.

Quarterly results are arguably a side-show for Deutsche Bank as the focus shifts to the new 2022 financial targets and restructuring.

But much weaker than expected revenues are still a bad omen for a strategy that relies heavily on revenue growth.

A miss on capital will also add to concerns about whether DB can get through this restructuring without needing more equity.

My target price is €7.16 which continues to signal no upside but plentiful downside risks.

2Q earnings bring no relief

2Q earnings were greeted with another 5% share price fall.

Deutsche Bank (NYSE: DB) is such a work in progress at present that it’s tempting to simply ignore short-term results and to focus on the 2022 financial targets DB gave in the strategy revamp on 8 July.

But judging by the price move, it’s clear investors are still looking closely at quarterly numbers as a guidepost to how on-track the company is for the 2022 targets.

2Q didn’t provide a lot of comfort and in fact, the results have sharpened investors’ focus on two aspects of the 2022 targets they are already skeptical of.

Revenue momentum remains very negative

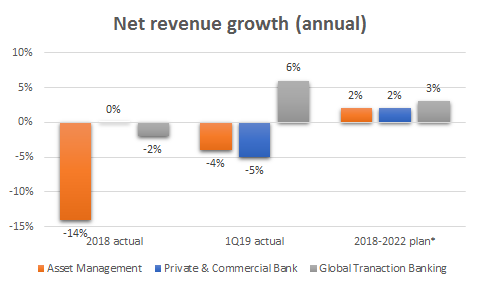

The first is revenue momentum. I’ve explained in a previous article why revenue growth is essential if DB is to have any chance of reaching the 2022 targets.

Unfortunately, 2Q was another quarter where revenues were headed in the wrong direction with the company posting a 6% YoY decline. Some of this was inevitable given the upheaval in the investment bank. But investors will be unnerved by DB’s inability to turnaround the downtrend in other areas that are less impacted by restructuring.

Revenues in the Asset Management business declined by 4% YoY and by 5% YoY in the Private & Commercial Bank. The 2022 plan sees both these important divisions delivering 2% pa growth.

Source: Company disclosures

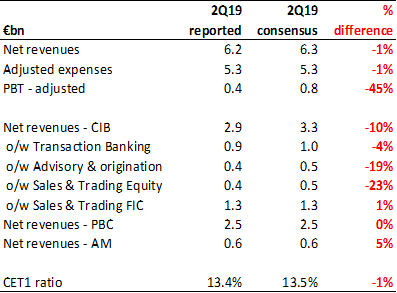

It can be argued nothing better could have been expected this quarter given the 2022 plan has only just been launched. But unfortunately, the market did expect better. The next table puts the 2Q results alongside consensus expectations as published by DB.

Group revenues were only 1% lower than consensus but in a number of important areas, especially within the investment bank, there was a huge shortfall to expectations – and not just in areas that are being exited.

For example, in Advisory and Underwriting, which DB wants to keep, revenues were 19% below expectations. In Equity trading, most of which is being exited, revenues were 23% below expectations. In Transaction Banking, which is a pivotal part of the new plan to create a corporate-focused investment bank, revenues were 4% lower than expected.

Source: Company disclosures, company-compiled consensus

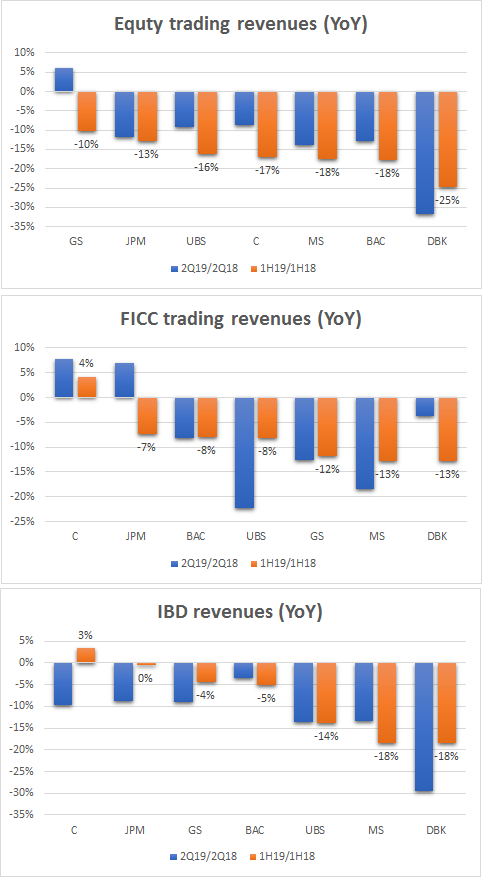

In all of the key investment banking revenue buckets, DB trailed the peer group in 2Q, as highlighted by the following charts.

Source: Company disclosures

This is important because DB has set a hard target of at least €25bn of revenues in 2022, equating to 2% annual growth versus 2018. If this growth can’t be delivered, ROTE in 2022 will be stuck at ~5% on my calculations rather than the 8% management is promising. There is a lot of focus on DB’s cost reduction plan, where the company wants to cut by around 25% by 2022 but these cost cuts will only get the company halfway to the ROTE ambition. The rest has to come from revenue expansion.

DB needs to start showing positive revenue momentum soon if investors are to retain any faith in the plan. A 6% YoY decline in 2Q isn’t a great starting point.

Capital is on track, but only just

I’ve also discussed in a recent article why capital is crucial to the 2022 plan. To avoid having to raise, DB is relying on quickly freeing up capital by running off €74bn of assets in the newly-formed Capital Release Unit to offset the hit from booking €5.1bn of restructuring charges this year and €7.1bn over the life of the plan.

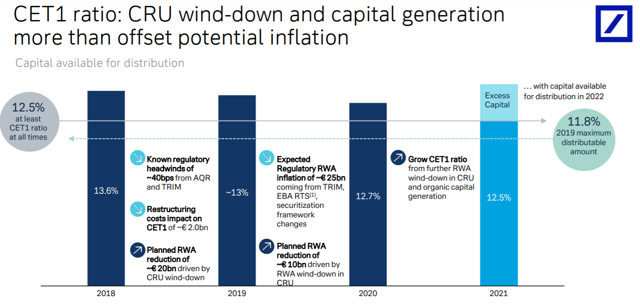

Even if this is achieved, DB still expects its regulatory capital ratio to decline in both 2019 and 2020. It has set a hard, downside core equity tier 1 target of 12.5% and it expects the ratio to trough slightly above this level at 12.7% in 2020 before rising thereafter.

Given DB’s regulatory minimum requirement is 11.8% the level of cushion to absorb mishaps is relatively small, especially as the plan crucially depends on the seamless run-off of the assets in CRU, which in turn depends on cooperative market conditions.

In the event the CRU assets aren’t run-off as planned, my calculations suggest CET1 will trough at 11.5% in 2020.

Source: DB strategy presentation, 8 July 2019

Given these factors, investors remain intensely focused on how DB’s capital ratios are developing from quarter to quarter.

A decline in 2Q was expected but, like revenues, the decline was worse than feared with core equity tier 1 ending at 13.4% against a consensus of 13.5%, down 30bps on 1Q.

Importantly, the decline wasn’t due to the absorption of restructuring charges associated with the 2022 plan – which could have been dismissed as one-off – but instead came mainly from changes to regulations. DB has flagged these will continue both in 2H and into 2020 and investors will fear the overall burden will end up being higher than expected, pushing trough core tier 1 below the 12.5% down-side limit assumed in the plan.

If this happens, the risk of DB needing to raise equity is very real.

Valuation remains uncompelling

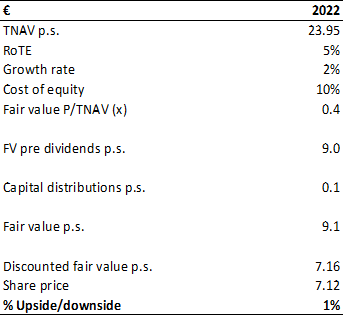

For my DB valuation I assume ROTE in 2022 is 5% rather than the company’s target of 8%. This is based on DB delivering all its promised cost savings but failing to achieve revenue growth.

I also assume that payouts to shareholders in 2022 are merely the level of this year’s dividend (€0.11 ps) rather than the €5bn (c.€2.5 ps) of dividends and buybacks the company thinks will be available for distribution in 2022.

I don’t see anything in the 2Q results that makes me want to change these assumptions. Revenue growth still looks a very distant prospect with the 2Q YoY growth rate being -6%. The chances of there being meaningful surplus capital to distribute at the end of the plan also look slim in view of DB continuing to miss core equity tier 1 expectations.

Based on these inputs, and assuming 10% cost of equity and 2% long-term growth, I get to a fair value target of €7.16 which is more or less the current share price.

Needless to say, with no upside but lots of downside risks, this isn’t a share I’ll be buying anytime soon.

Fair value calculation based on ROTE/COE

Source: Author’s calculations

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.